Accounting for the admission of a new partner

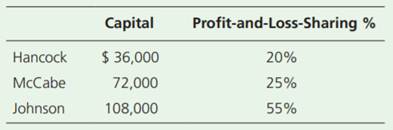

Hancock, McCabe, and Johnson, a partnership, is considering admitting Kevin Sacchetti as a new partner. On July 31 of the current year, the capital accounts of the three existing partners and their profit-and-loss-sharing ratio is as follows:

Requirements

Journalize the admission of Sacchetti as a partner on July 31 for each of the following independent situations:

1. Sacchetti pays Johnson $144,000 cash to purchase Johnson’s interest.

2. Sacchetti contributes $72,000 to the partnership, acquiring a 1/4 interest in the business.

3. Sacchetti contributes $72,000 to the partnership, acquiring a 1/6 interest in the business.

4. Sacchetti contributes $72,000 to the partnership, acquiring a 1/3 interest in the business.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"